Brexit Brexit Brexit Brexit Brexit Brexit… If you want to know where I stand then…You’ll never know because to publicly come out is far too divisive!

They do the okey cokey and they turn around, that’s what it’s all about.

On property though I can give you a low down from an investors perspective.There were predicted price drops of over 30% upon a vote to leave. Since the referendum prices have risen by 8% on average across the UK. If you had waited for the uncertainty to pass over that period, you would have missed out on 8% growth, or with a 75% leveraged buy to let, a 32% uplift in the value of your equity.

32%!

One of the world’s richest men is Warren Buffet, he’s made a lot of money running into fires whilst everyone else is exiting the building, whilst many investors are pausing their investments, people like him and who have studied his methods are going in and buying undervalued property and making these kinds of returns whilst others are running from the flames.

Warren Buffett looks at what people are running from and oftentimes finds it artificially devalued.

What’s the downside?

Brexit can go wrong in a number of ways, the supercrash that the media are telling us will happen could happen if we make a clean break. On the other side, if we don’t exit at all then our democratic institutions and parliamentary system may get turned over by protest and/or vote. Either way there’s bound to be unrest and unrest brings gifts.

Government backed gifts!

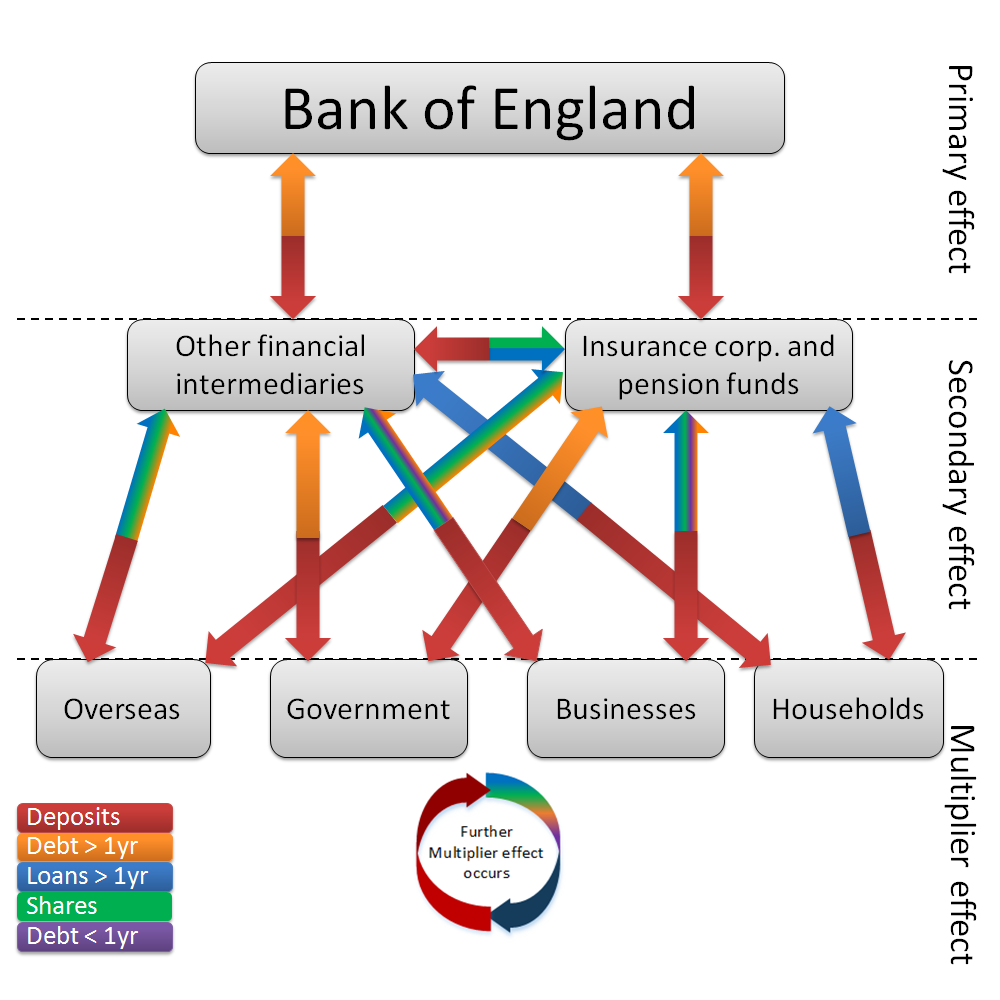

Case in point, the Yellow Vests in France were offered tax breaks by Macron after a number of protests.Another recent case… The recent economic crash followed government programs such as Quantitative Easing and bailing out banks. Should there be an economic event in the UK that affects property prices then there will be stimulus packages put in place.

If Brexit goes well then great, if not then we will be stimulated, of that you can be certain.

The Government can be relied upon to give out gifts during difficult times… and to overcomplicate the breathtakingly simple

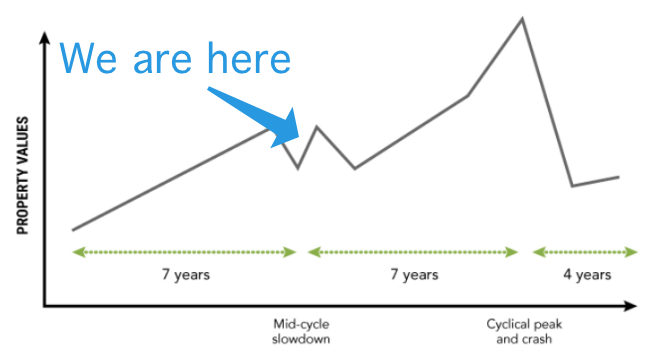

Then there are the cycles, we are mid way through an 18 year cycle at a point where prices are due to dip before they boom followed by the crash at the end (which barely scrapes the top off the boom).And in many parts of the country this cycle is playing out exactly to the predicted cycle, a cycle that existed long before Brexit… or even the EU for that matter.So that’s Brexit, Buffett, being stimulated, house prices and cycles, I’m afraid the headline is more exciting than the story…

The cycle exists, it’s on time, it’s predictable and this time Brexit is a cause for a small part of it.

We’re in year 7 of an 18 year cycle that looks like this.

If you study property, property history, values, cycles and income then it will help, all you need to know is that you invest smart. Invest in areas of growth, places that there’s a high rent demand, make sure your cashflow pays you well and monthly so you’re insured against risks and you will make a handsome profit.If you pick your areas correctly you can create great cash flow, high returns and get high Capital Appreciation, our latest property generates £312/month profit after expenses out of an investment of less than £10k… The method and approach is here:https://keypropertiesuk.co.uk/property-training/how-to-make-50k-out-of-a-100k-buy-to-let-property/

Leave a Reply