In recent times the property market has acted in a way that’s not coherent with a shrinking economy or a pandemic situation. It became very difficult for us as property investors and traders to buy properties in these market conditions.

One property that we were looking to buy was listed at auction for £46k and sold for £94k. It required £30k of refurbishment work which would have lifted it’s end value to £120k, no profit in it at all, in fact, a slight loss.

I’m used to seeing auctioneers price certain properties low in order to fill their rooms, and I’ve seen hundreds of people turn up thinking they might get a £20k or £30k house. In reality though, the bids competing for the low value properties drive the price up, it’s a false economy, some leave, some bid on other things in an attempt to salvage their wasted trip.

What was new to the market though was the influx of capital from bounce back loans which pressurised the market (the gov will turn a blind eye). This influx of capital, £50k at a time was spent by many people inappropriately on low end properties, I’m expecting to see lots of these come back onto the market in 12 months or so as they realise what they got themselves in to.

We also and lack of stock as people with empty houses and people with things like probate properties decided to hold onto them during the lockdowns. Couple that with the building firms and trading businesses that need a continuous flow of properties in order to cover their operating costs and you had a perfect storm for inflating the value of low end properties. That bubble has now burst and the results are that it is again a buyers market as more and more stock becomes available to buy. There is an elastic band effect as the stock that was previously held back gets put on the market, the bounce back loan users have cashed out and the rest of the market has normalised, there are bargains to be had. So, where is the market going next? To look at that we must first understand the economic situation that we are in. What we have due to the pandemic is a government with the equivalent of a wartime debt. Wartime debt is removed via inflation, so expect to see the government pushing inflationary measures going forwards.

Inflation is the devaluing of a currency over time. By printing money, central banks make the current money in circulation worth less as there is more of it. Put simply, if you halve the value of your currency you halve your debt because the £1 you owed is now worth 50p.

The BoE and central government of the U.K. will push agendas that drive inflation faster than they did before as a tool of recovery from the pandemic. It’s what governments have always done, there’s no reason to think that now is any different. The banks themselves are cash rich at this moment in time and are dropping interest rates on mortgages quite quickly. 95% mortgages are back with a percentage guaranteed by the government. I’ve heard some noises that self certified mortgages might not be too far away. Big institutional lenders have access to data we don’t have, super computers, modelling software, some incredibly brainy and qualified people, it’s also their money on the line in a lending situation. If they’re opening up the taps to lend more freely then that only tells you one thing, they are confident about the property market, economy and the direction of travel. I was listening to an economist and one of the UKs biggest landlords yesterday, he says the cyclical crash has already happened, 2010 – 2020 saw such low house price increases (on average) that they went down in real terms vs inflation. That is a property market crash, it already happened and it happened in slow motion, so slow that we almost all missed it happening.

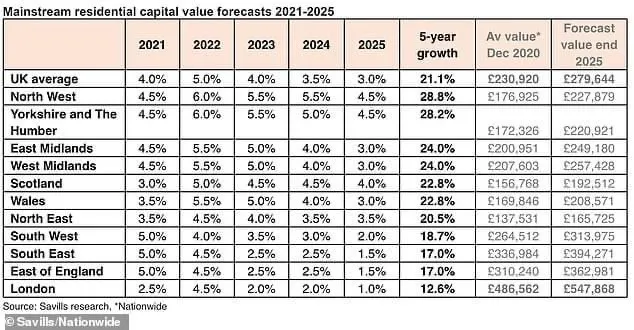

Savills are one of the best economic forecasters in property in the U.K. and their forecasts for sales and rentals over the next 5 years are below.

They mirror all the other metrics that I’ve been looking at, very barometer is pointing in the right direction at this moment in time.

The outlook for the next 5 years is therefore turbulence but also significant property price growth.In the words of the aforementioned landlord / economist “I can’t remember the last time I was this bullish about the property market in the short – medium term”.

Leave a Reply