Welcome, we source and manage high yield properties for investors all over the U.K. but with a particular focus on Swansea, here’s why…

Read more about Swansea’s growth and potential here:

Investing in Property in Swansea in 2023

House Prices – the factors affecting the market

The Magic of South Wales and the Property Market

The 2020 – 21 Pension Crisis – A Covid Repercussion.

Japanese Knotweed Investment Facts

Tenant Quake – Incoming Changes In The Lettings Landscape

Want first access to our best properties?

If you would like first access to our properties then book a call with us below

[tcb-script type=”text/javascript” src=”https://assets.calendly.com/assets/external/widget.js”][/tcb-script]

Martin Howard – DirectorE: martin@keypropertiesuk.co.ukM: 07851 873995

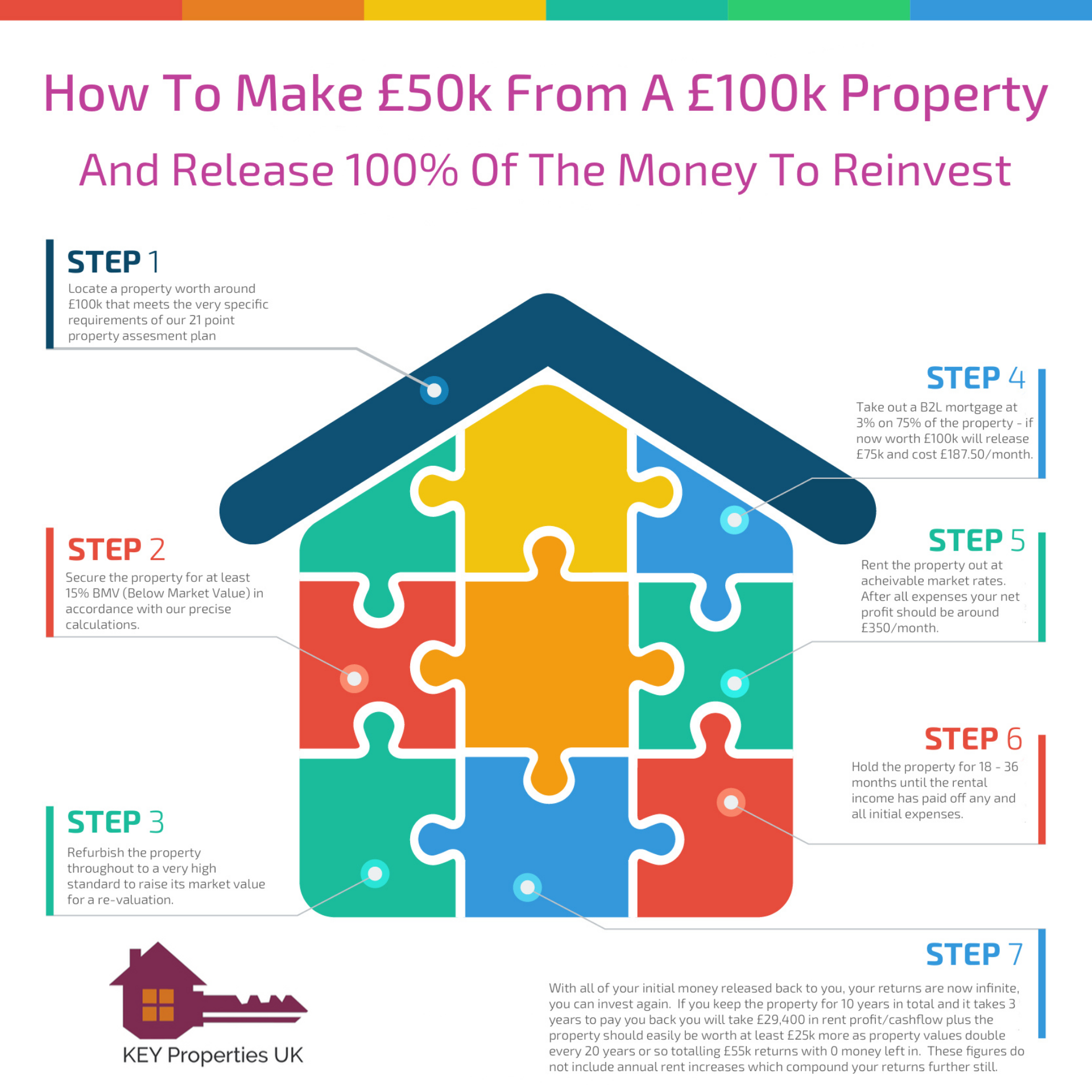

We typically deliver our investors a Return On Capital Employed (R.O.C.E) of over 25% and even more with 4x leverage on the capital appreciation using our unique methodology

*Illustrative figures only, 25% refers to R.O.C.E. (Return On Capital Employed) full explanation below, please ask.

- Locate A Property we can buy Below Market Value (BMV), add value to or both.

- Calculate all costings including refurbishment, duties etc.

- Refurbish to a high standard.

- Sell for instant profit or…

- Use the new value of the property to obtain a Buy To Let Mortgage against 75% of its new value, releasing almost all of the invested money back to you and giving you 25% equity in the property.

- Rent out the property normally for a profit of over £250 per month after paying the mortgage and a lettings agent to manage it.

- Within a short time, your full investment is paid off and you have a cash flowing asset that is rising in value.

- Leveraged finance for capital gains. If you own 25% of a property worth £100k and the value increases 12.5%, that £12,500 increase is all yours and turns your equity from £25k to £37.5k, an increase on your equity of 50% or 4 x leverage on the 12.5% property price increase.

Our unique method for growing your wealth is Illustrated below

How we calculate returns from our properties

Each of our properties passes stringent checks to ensure it’s profitability, watch the video below to get a key understanding of our calculations and how they work. All our calculations are open to you so you know exactly how we’ve come to our conclusions.

Missing Image

Return ranges

Each property comes with a worst and best case set of figures, presented to you in the format below for easy consumption.

Valuation

R.O.C.E

Equity

Money Left In

Months To 100% Return

Here’s a recent property of ours

If you would like to see examples of properties that we have completed on for the level of ROI and ROCE, please visit here.