Key Properties Uk Sources Properties for investors with great yields and multiple exit strategies.

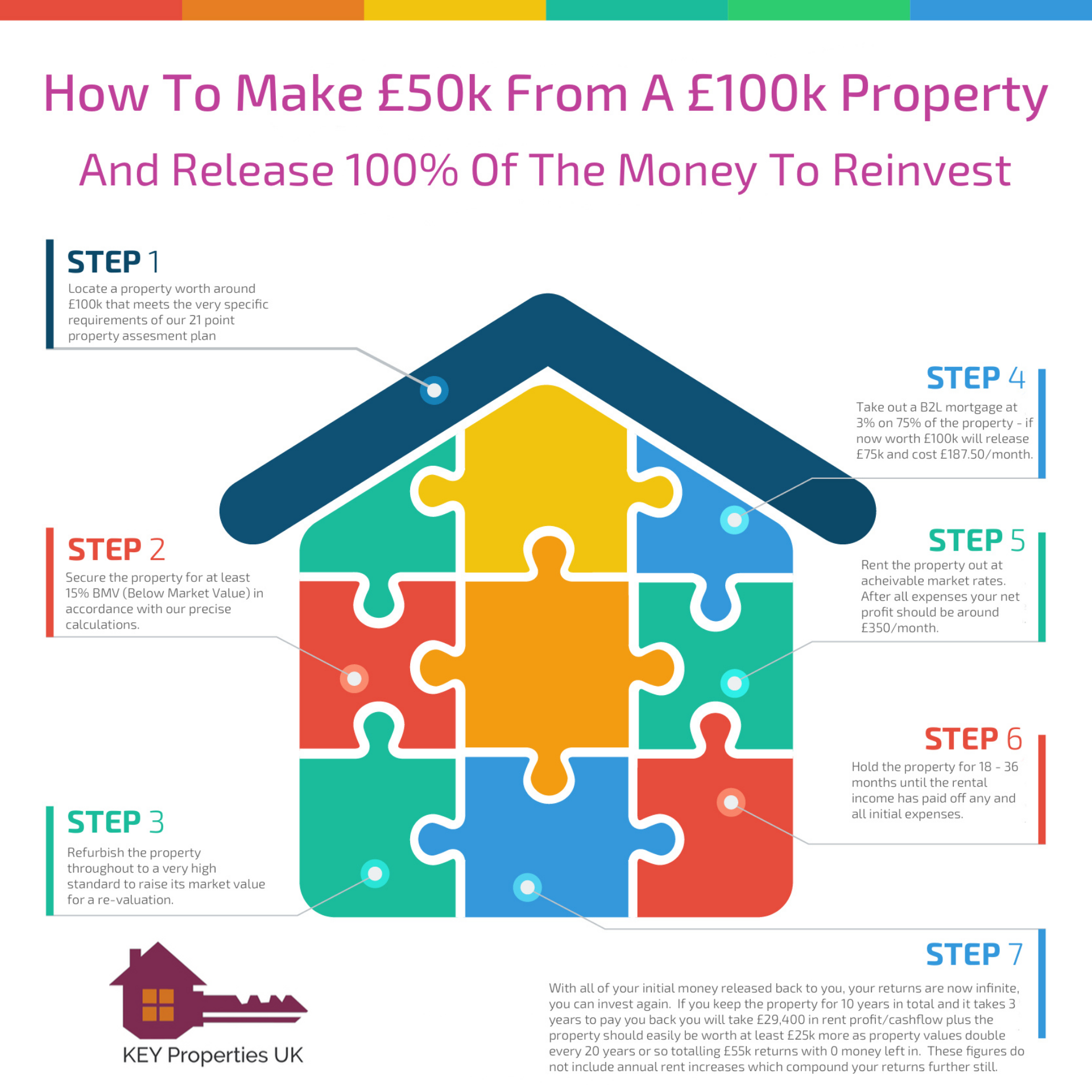

One of the standard methods we use to generate returns for our investors is detailed here.In essence we source a BMV (Below Market Value) property that meets our 21 point property sourcing checklist requirements – you can download the checklist here. This is a property that can have value added to it via refurbishment.After refurbishment the investor takes out a Buy To Let Mortgage on 75% of the new value of the property now it’s been refurbished thus withdrawing almost all the investment money back out and leaving a small amount left over (typically around £9000).

You can see more details about this strategy by clicking the image above.

After interest only buy to let mortgage expenses (available from 1.5% today but we calculate for 3%), agency fees and everything you need for it to be managed hands off the property would cash flow about £300 / month and therefore pay off the investor in full in around 30 months time.After that the £300 / month cash flow would be all profit and that’s not including rent rises of 2 – 3% every year.Property as an asset class weathers all storms better than others and appreciates strongly in the right areas.Properties that meet our 21 point checklist requirements typically more than double in value every 20 years.Should an investor hold on to a £100k property for 10 years, that pays him or her back inside 30 months; and it appreciates just 25%(half of what’s expected/normal) in that time then the result is that they clear £50k profit…From a hands off asset that has none of the investment money left in after just 2 and a half years.In short the money could be rinsed and repeated.There is no other investment that pays back monthly cash flow, is as safe as houses, is illiquid to stop your money being taken and spread easily and appreciates in value.Monthly positive cash flow is the key though, it covers off all eventualities

Leave a Reply