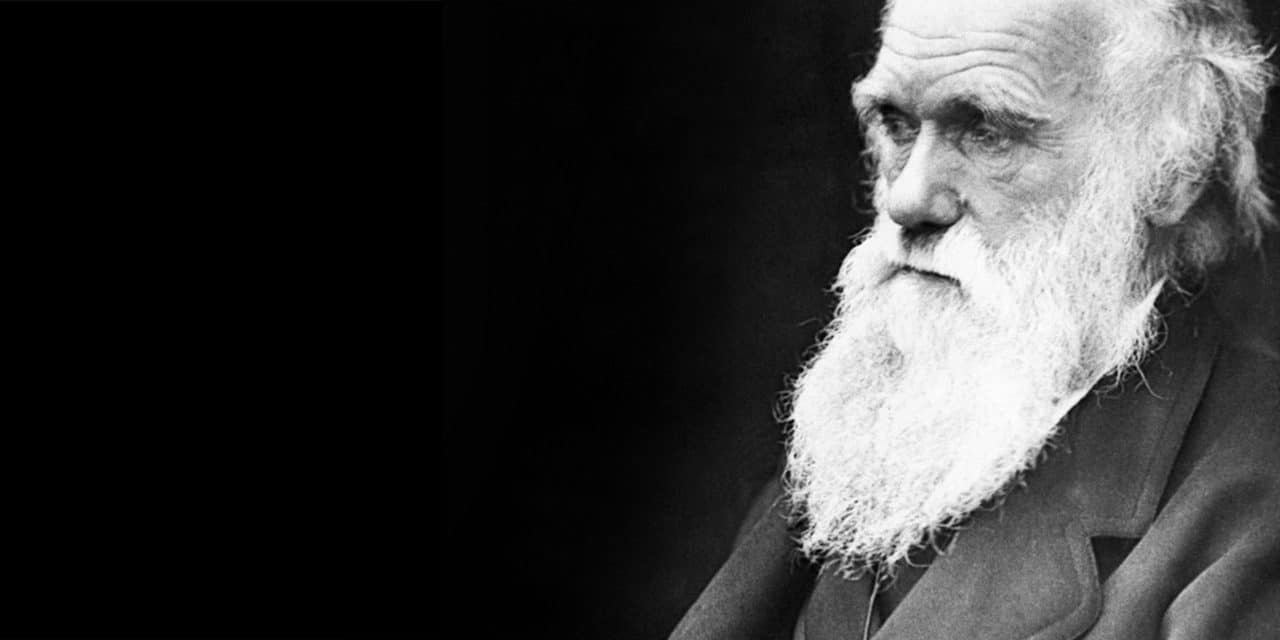

The world of lettings is changing and that means fear, worry and doubt for many landlords and lettings agents.This is where I sniff opportunities, changes mean advantages for the fastest movers, the quickest thinkers and the most adaptable, changes mean Darwinism.

The most adaptable of the species survive and thrive which is why changes mean opportunities for those willing to learn and grow.

So what are the changes?

1. Tenant Fee Ban (Terrible decision by government) 2. Section 24 (Another terrible decision) 3. Reduced power to select tenants (Yet another poor decision)

Tenant Fee Ban

Because of a few unscrupulous agents and landlords charging extortionate fees the government decided to punish everyone. Like a teacher keeping the entire class back at lunch because of one rowdy pupil they’ve made a rod for their own back as some landlords reduce and recoil.Who pays to credit check prospective tenants?What if they want to bring things into your property that you’d like to let them have but might cause damage such as a dog?Who pays the inventory and agents fees etc.Of course the answer is that the tenant does as landlords will have to hide these costs in higher rents.

No tenant fees means higher rents, landlords should not have to pay for government housing policy failings.

This is where the government is shooting itself in the foot, on the one hand it wants more affordable rental housing and more properties available for families… on the other it’s making many landlords think twice, and this is where we (you and I) can take advantage.

Section 24

Already in place, this new tax on private landlords (and yes, for all you political people out there, I class it as a bonafide new tax) puts them in a position. Sell or lose income and profits.

Section 24 is a new landlord tax.

Even if they start a new Ltd company and transfer their property assets to it they will still have to pay the relevant stamp duty for each transfer as if their company had paid a full and fair market value for the property.There are some smaller landlords that I know that have simply stopped renting out their homes due to this.

Reduced power to select tenants

This is actually quite fair. The government has a duty to provide housing to its people and the private rented market 90% or so of the time said no tenants on benefits.

Given that 1/3rd of children are in poverty (a questionable figure I know, I define poverty far differently to the UN/Government, people who walk miles for water are in poverty, we all have it on tap) and the demands on UK housing it is wholly reasonable that the government should legislate for and demand parity in housing applications.And this is where we can get smartFirstly, with potential investors and landlords in a state of fear they will be watching and waiting, pulling away from the market… this is exactly the time to step in and grab market share, think growth.Secondly, set up a Ltd company and operate within that structure, the section 24 taxation issue doesn’t even exist then. If you’re running a property business or any business, however small or large, the benefits of being a Ltd company are huge and you should probably have one.Thirdly tenant fees and selection, now it’s time to play smart. Your area must have a high rental demand so that you have multiple choices in who becomes your tenant and can set higher prices. These prices negate the fees missed out on via the tenant fee ban and this choice takes away the issue of having to accept certain types of tenants.You can demand guarantors, credit check, take out insurance to protect your rental income, ask for references and more.Get a high quality lettings agent, source your properties with care, use quality sourcing agents, pick your areas wisely and move forwards.Advance quickly whilst others stall and when they realise that there’s still money to be had they’ll be behind the curve and you’ll be ahead.Brexit referendum – vote to leave = 20% house price dip… allegedly.House prices on average have risen 8% since then. If you had £25k equity in a £100k house that £25k would be now worth £33k (because the capital gains are all yours, not the mortgage company’s) and your increase would be over 30%.If you were making £300/month profit in that time from rentals you would’ve made a further £10,800.Making £18,800 out of £25,000 worth of equity over 3 years of what are supposed to be the most troubled times in years isn’t half bad is it?It’s a 75% return!If you’re looking to take advantage and make moves thenhttps://keypropertiesuk.co.uk/investment-opportunities/

Just as in the survival of species the most adaptable survive and thrive, the same is true in business and especially so in property so let’s take advantage of the government led tenant quake, protect ourselves and step into the breach.

Leave a Reply